This post is mostly aimed at small investors without Broker Dealer licenses and those who target them.

“Turn off your mind relax and float downstream.”

Because you are the fish, and if you take someone’s advice and invest in iron condors you will soon be begging for someone to teach you how to fish.

I spent over ten thousand hours standing around trading all day and making money, and I have never traded an iron condor intentionally in my life. When I was on the trading floor, I never even saw one trade, but they are even sillier today.

When I was a moron with about three hours of experience, I did think condors were cool, but I was stupid they just sort of seemed cool. They are a waste of time and capital, and the “iron” version is even worse.

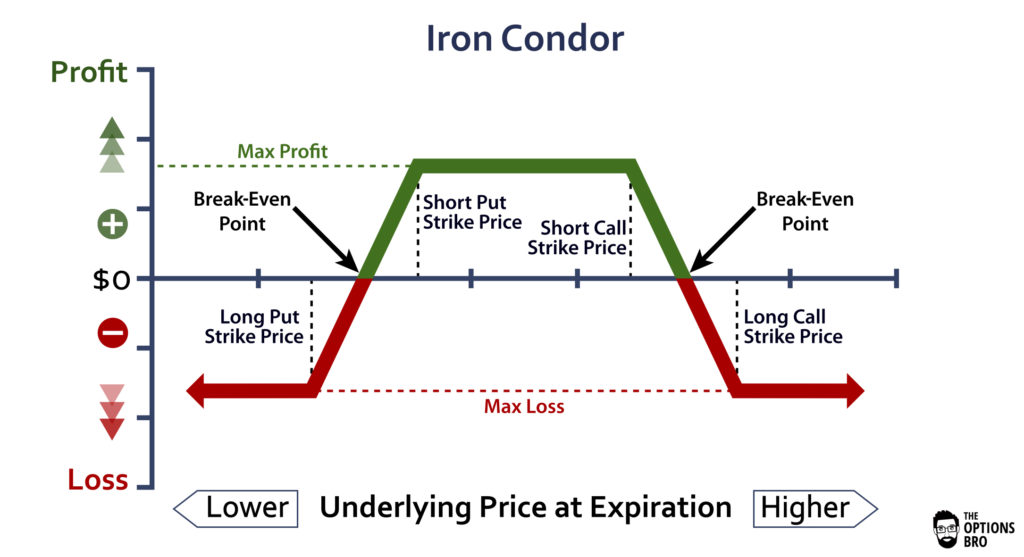

You know the experts that make money predicting where a stock is going to go? They do lots of research and try to decide if the stocks are going to go up or down, or maybe even if the stock is just going to be wacky for a while. You can make money on all of that with stock options. If you have an accurate opinion on a stock, you can probably make a lot of money by using stock options to bet on it. You can make lots of money trading stock options with good opinions. Iron condors are basically having no opinion.

If you think that graph is cool I guess that’s cool. If you hate it you can do the opposite and flip it upside down and bet on the opposite.

What are you betting on? Well if you buy that iron condor or sell it (it’s complicated) to get that graph then you are gambling on nonsense. You aren’t gambling the stock is going up or down, and you aren’t gambling on it moving or not moving for the most part. You are basically putting a bee in a jar and gambling on its precise location in the jar on a certain date and time, which is pretty random unless there is a lot of honey caked on one side of the jar.

Here’s the positive thing about an iron condor. You have limited loss. There’s nothing more fun than selling options on a stock that doesn’t move and just watching their value dissipate into nothing. The problem is that selling them naked means that you can have 20 awesome days and then wake up on day 21 after a surprise earnings alert and lose a ton of money.

There’s also the problem that people that let you trade options are aware of how risky it is to let you risk losing a ton of money on a huge move. They will either require that you have a ton of money in your account or just not let you do it.

So sure iron condors do have limited losses.

So let’s say you are a bee enthusiast and love watching. Here’s how incredibly stupid selling options premium with this trade is.

Trading options is about “edge.”

Every time a customer on a computer (you) trades an option he is giving up edge.

First, you pay commissions, which is not a theoretical loss of money its just throwing money away. Don’t go to Vegas to bet on the Browns/Steelers game find your Steeler fan friend and do it for free and don’t lose edge.

The ones who collect commissions? Free money. Great job.

Now to trade an iron condor you don’t do that once. You do it FOUR times.

Then you usually have to give up more edge just getting someone to take the other side.

Take a random options market. Say the market is 4.10-4.20.

That means the smart people feel the option is worth 4.15 and they will buy it from you for 4.10 or sell it to you at 4.20 to get .05 of edge.

Now you can throw a bid or offer in at the recognized fair value of 4.15 and maybe eventually your Steeler fan friend is going to take the other side, but you don’t want to trade an option you want to trade an iron condor, and putting on one quarter or one half of an iron condor is incredibly risky.

Then you have to again give up that .05 FOUR times. There are multi-millionaires out their walking expensive poodles from a lot of nickels. Only give up your nickels for a good reason. So you basically wanted to put a trade on for God knows what reason and you paid commissions and fees four times and then gave up 20 cents of edge. Not smart. The world is run by smart people.

Are you thinking? Yeah, you could just put an order out to execute your iron straddle all at once and maybe some Steeler fan will want to take the other side. This will not happen immediately unless your guess as to its value is way off. You don’t want to trade with people who think your order is stupid.

Of course, the whole time you have your order out there the stock is constantly moving like a bee in a jar looking for honey that isn’t there. This changes the value of your iron condor and you will usually wind up with your iron condor when it has lost the most edge.

If you have an iron condor order out there with no or some edge you have to find someone far dumber than you to take the other side.

Ok, now let’s say you get lucky on your iron condor order and get it with some edge. Take my word for it you pretty much have to sit on it and wait for it to expire. You may make a little money on the bee in the meantime, but to get out of your iron condor you must then make four more trades with commissions, fees, and lost edge to get out of it. Mostly, you are married to it until it expires and whether you make money on it is very random.

Anyone with a brain that is honest will tell you that.

Here’s another issue. You are buying the out of the money options. These usually trade higher than their theoretical value because they are dangerous. The seller is taking in less premium and has more to lose if the stock makes a huge move. Professional traders don’t like to risk a huge loss to take in a small amount of money so they usually sell at a higher implied volatility than the meatier options.

Sure you own these riskier out of the money options, but you aren’t betting on making exponential gains from a big move. You are hoping the stock doesn’t move at all. So every iron condor that you the customer puts on is more than likely going to look like a theoretical nightmare to a computer valuation of that spread that professionals use.

If the stock just sits there until expiration you will make money, but you’ve basically gotten lucky giving someone a 52% payoff on a coin flip. If you win coin flips 60% of the time, do that. If you have normal coin flipping abilities or do not have a really good reason for thinking the stock is just going to sit around for the next month. It’s a pretty bad idea.

Why do people recommend iron condors? They seem clever and the graphs look cool. Real traders never trade them unless someone wants to do it really stupidly and then they take the other side. They take in a little edge a bunch of times and the statistical concept called the law of large numbers means they will capture that edge in the long term.

You on the other hand aren’t doing this for positive edge 100,000 times you are probably doing one or two a month. The law of large numbers doesn’t apply to you. You have to get lucky.

Basically, they are a good way to take say $5000 and maybe make like $2500 in a month or two or lose $2500 in a month or two or maybe break even or make a tad less or lose a tad less.

Very little downside for the recommender. You aren’t going to lose a fortune. If you make a little you will be happy. If you lost a lot, at least you tried and had fun watching the bumblebee, but the one bumbling was you.

If you make money, they will put your kudos on their Twitter feed. If you lose a little they won’t. If you lose a lot they definitely won’t. You can Tweet your loss, but your Twitter following is much smaller than theirs. That’s how you found them in the first place.

No risk to them. You paid them to learn how to be silly and stupid. They’re in this to make money. They want you to make money because it means more money for them.

They don’t want you to truly learn, because if you truly learn you don’t need them anymore.

I never have heard this answered. If someone is making so much money trading iron condors, why would they recommend them and have everyone trying to find edge in the same way as they do? Competition means loss of edge.

The guy who taught me options? Smart.

They would have him on television and ask him for recommendations, and he would recommend that clueless people come into the market and take him out of his bad trades.

Last question. Are the iron condor recommenders stupid or morally bankrupt?

Does it matter?

Not to you and your checkbook.

Note from the author. I can’t remember for the life of me what this video was of but I’m pretty sure it was hilarious.

Smarter? Contact me and show me what you have been recommended, and I will for now tell you for free if it is stupid or not. Or you can just expect it is stupid because it will be 95% of the time.

Unless you are worth $5 million dollars and have a Broker/Dealer license trading complex options spreads are stupid 95% of the time.

Sorry to burst your bubble and rain on your parade. Find a better parade.

Your random broker who has no idea if a stock is going up or down, but says “Hey, it could go up!” is offering you a much better deal.

Want more proof? Google “iron condor stupid.” It’s not really a secret.